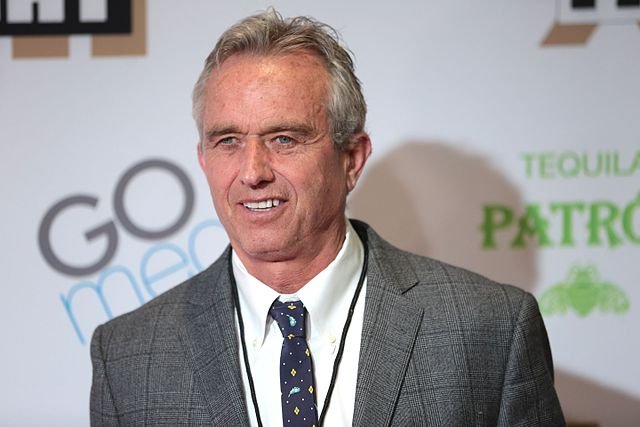

Right Wing Media Money Mavens Cozy Up to RFK Jr.

Right Wing Biz Watch

By David Lieberman, July 4, 2023

Robert F. Kennedy Jr.’s anti-vax conspiracy theories are too far-fetched for the fact checkers at YouTube. But the Democratic presidential candidate should feel right at home on Rumble, a right-wing alternative to YouTube where RFK Jr. has begun to offer livestreams and clips from his speeches and interviews.

The son of the late Sen. Robert F. Kennedy recently said he would use his perch next to Donald Trump Jr., Kimberly Guilfoyle, Steven Crowder, and Alex Jones to “take back this country from these corporate powers that seek to divide us.”

His idea of divisive corporate powers apparently doesn’t include Silicon Valley venture capitalist David Sacks, a supporter of Florida Gov. Ron DeSantis and Ohio Sen. J.D. Vance who has endorsed him and just joined the Rumble’s board.

The candidate also is backed by Omeed Malik, who’s a contributing editor and minority owner of the Daily Caller. He’s also CEO of Colombier Acquisition Corp. – a SPAC that in February agreed to provide financial support for Public Square, which hopes to become an alternative to Amazon for companies that agree to “not support causes that are in direct conflict with our core values.”

Its values include opposition to diversity, equity and inclusion initiatives and environmental, social and governance reforms that Public Square says “have left many patriotic Americans wondering where they can spend their hard-earned money in alignment with their values.”

TRUMP HOLDS TO SEPT. 8 DEADLINE FOR DWAC MERGER DESPITE ITS AGREEMENT TO SETTLE SEC FRAUD INVESTIGATION

Is Donald Trump about to bail out of his 2021 deal to merge Trump Media and Technology Group (TMTG) with Digital World Acquisition Corp. (DWAC) – an arrangement that could funnel nearly $300 million to the parent of Truth Social?

That seems likely based on a DWAC filing on Monday that also discloses a tentative agreement with the Securities and Exchange Commission to end its insider trading investigation into the publicly-traded Special Purpose Acquisition Company (SPAC).

That investigation helped to sour DWAC investors on its 2021 merger agreement with TMTG, an arrangement that would keep Trump’s Twitter-like platform afloat with cash and a publicly traded stock. DWAC has postponed a shareholder vote four times.

The current terms governing the SPAC require it to liquidate if it doesn’t combine with TMTG or another operating business by Sept. 8. Investors would receive a pro rata share of what’s left of the $293 million DWAC raised from them after accounting for expenses and the interests of those who bought preferred shares.

DWAC hoped to extend that deadline by a year with a plan, disclosed in a recent preliminary proxy filed with the SEC, that would offer to buy the shares of those who want out. That, presumably, would move opponents of the TMTG deal out of the way so supporters could hold a special meeting to change DWAC’s articles of incorporation allowing for the one-year extension.

The initiative to extend the deal deadline would have to be supported by at least 65 percent of the holders of DWAC’s publicly traded shares.

But there’s another vote that matters: one from the former president — who apparently doesn’t want to extend his deal with DWAC.

Trump’s firm said that it is “only bound through September 8, 2023,” DWAC reports. It adds, in a curious aside, that TMTG has delayed in “providing various deliverables … required to consummate a business combination.”

The SPAC says that it “remains very interested in the transaction with TMTG and is hopeful DWAC and TMTG can resolve this interpretative divergence.”

If they make amends, then DWAC would have $18 million less to offer TMTG based on the tentative deal the SPAC just made with the SEC. It agreed to relinquish the cash as part of a “civil money penalty” if it closes a deal with TMTG – or anyone else.

DWAC also would accept a cease-and-desist order finding that it had “violated certain antifraud provisions of the Securities Act and the Exchange Act” in its “statements, agreements and omissions” about the 2021 merger agreement with Trump.

SEC commissioners still must approve DWAC’s tentative settlement agreement. If they do, then we might learn more about the company’s legal woes if it merges with TMTG or another company. The terms require DWAC to make sure its deal disclosures are “materially complete and accurate and consistent with the findings in the Order.”

They could tell a fascinating story. On June 29 the SEC and U.S. Attorney’s Office for the Southern District of New York charged three people – including former DWAC board member Bruce Garelick – with insider trading in the Trump deal.

The complaint says that from June through most of October 2021 they knew something that the public didn’t: the SPAC was preparing a merger deal with TMTG. That enabled them to buy DWAC shares at about $10 a share and then collectively realize “illicit profits of more than $22.9 million” after the pact was announced in late October. That sent DWAC’s stock price soaring to as much as $175 a share.

DWAC closed on Monday at $12.65.

Garelick left the DWAC board in June 2022 after investigators began looking into transactions by him and colleagues at an investment firm, Rocket One Capital. When The New York Times reported on the situation the following month, Garelick’s lawyer sent the paper a letter threatening to “assert claims for defamation for any article that states, suggests, and/or otherwise implies that Bruce J. Garelick committed insider trading or any violation of the law.”

DWAC might have to leap one additional regulatory hurdle. The Committee on Foreign Investment in the United States could deem DWAC to be foreign-owned – and therefore subject to national security restrictions – the company says. DWAC was sponsored by ARC Global Investments II LLC, a subsidiary of the Shanghai-based financial services firm ARC Group.

DWAC director Patrick Orlando, who was CEO until March when he was terminated due to what the company described as “the unprecedented headwinds faced by the Company,” represents ARC Global’s interests. DWAC says the ARC subsidiary controls about 17.2 percent of its shares and would own “no more than 8.1%” of the company following a merger with TMTG.

ARC was founded by Abraham Cinta, whom Reuters described as a “former official at Mexico’s Ministry of Welfare.” He and some colleagues were reprimanded by the SEC in 2017 for “misrepresenting businesses they tried to take public and making false statements about their affiliation with them,” Reuters said. “In a rare move, the SEC stopped them from taking those companies public at the time.”

LEADING CONSERVATIVE CONTENT COMPANY FACES NASDAQ DELISTING

Salem Media Group, which bills itself as “America’s leading multimedia company specializing in Christian and conservative content,” may have to do some financial tap dancing to keep its stock on Nasdaq.

The exchange told the home of right-wing commentators including Dinesh D’Souza, Sebastian Gorka and Trish Regan on Friday that it has “failed to comply with the $1 minimum bid price” for its shares in the previous 32 business days, Salem said in an SEC filing.

The company closed Friday at 96 cents, giving it a market value of about $26 million. It has until Dec. 20 to lift the stock price to $1 or more for at least 10 consecutive business days to avoid being delisted.

Salem makes most of its money from radio and has suffered from the weak ad market that also has hit rivals including iHeart Media and Audacy. But it lost more money than it had forecast for the first three months of 2023 – and told investors that it will likely do so again in the current quarter.

Salem says it might consider unspecified “available options” to regain compliance if shareholders’ view of the company’s prospects don’t improve.

They don’t necessarily have to affect day-to-day operations. Firms facing delisting often enact a reverse stock split, exchanging two or more shares worth less than $1 for a single share worth more than $1. For example, on Friday Audacy announced a 1-for-30 reverse stock split.

Right Wing Biz Watch is a ongoing series of articles examining the business and finances of right wing media. Its author, David Lieberman, covered the media business full time for 30 years at USA Today and other publications before joining The New School as an Associate Professor in its graduate Media Management program.

Interested in more news about right-wing media curated especially for mainstream audiences? Subscribe to our free daily newsletter.

RFK Jr., the Democratic candidate for president, has received backing from the likes of Silicon Valley venture capitalist David Sacks, a supporter of Florida Gov. Ron DeSantis and Ohio Sen. J.D. Vance, as well as Omeed Malik, a contributing editor and minority owner of the Daily Caller. (Image: Wikimedia Commons)